Price floors prevent a price from falling below a certain level.

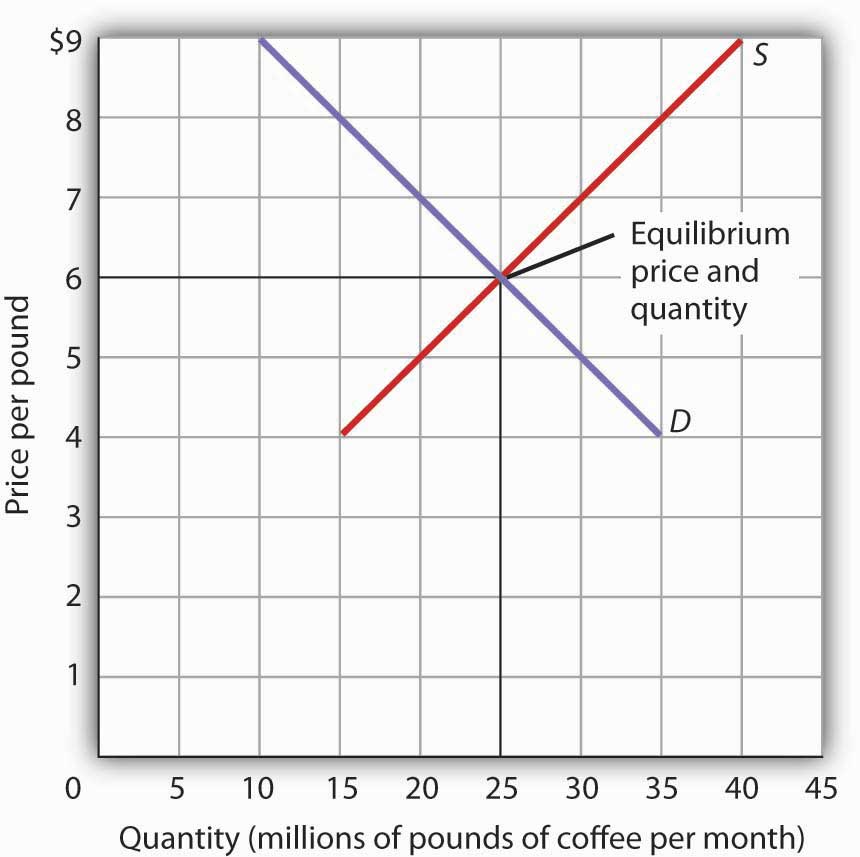

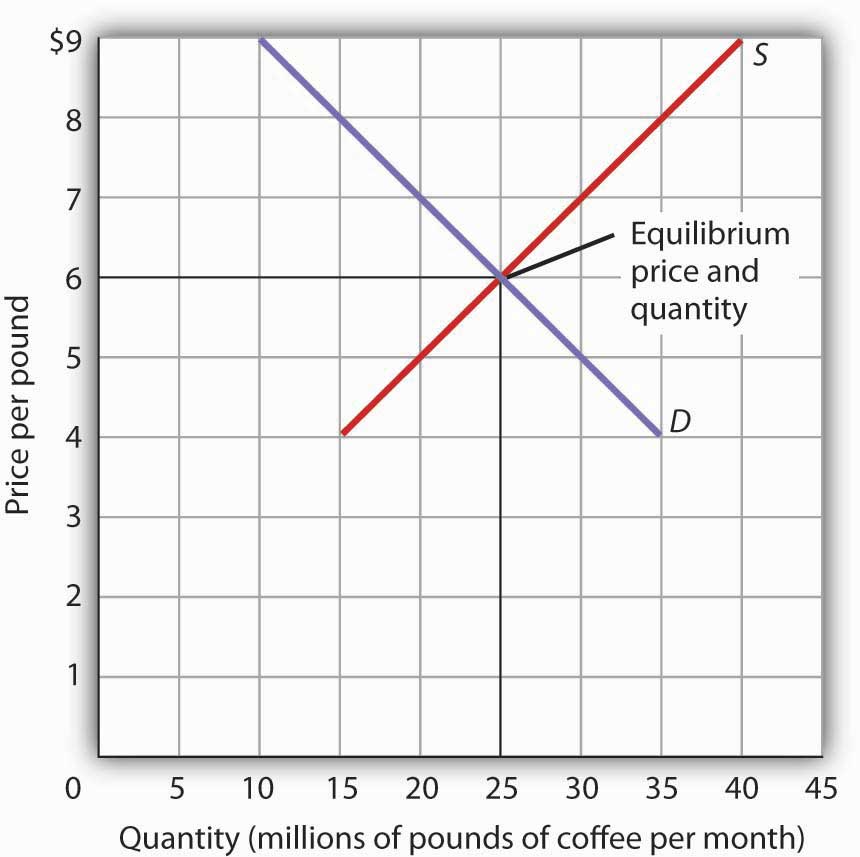

Effects of a floor price on market equilibrium.

When a price floor is set above the equilibrium price quantity supplied will exceed quantity demanded and excess supply or surpluses will result.

If price floor is less than market equilibrium price then it has no impact on the economy.

Price floors and price ceilings often lead to unintended consequences.

Surplus product is just one visible effect of a price floor.

In other words they do not change the equilibrium.

When a price floor is set above the equilibrium price quantity supplied will exceed quantity demanded and excess supply or surpluses will result.

It s generally applied to consumer staples.

The price ceiling is usually instituted via law and is typically applied to necessary goods like food rent and energy sources in order to ensure that everyone has access to them.

More specifically a price ceiling in other words a maximum price is put into effect when the government believes the price is too high and sets a maximum price that producers can charge.

Price floors prevent a price from falling below a certain level.

Consumers are always worse off as a result of a binding price floor because they must pay more for a lower quantity.

Some suppliers that could not compete at a.

They simply set a price that limits what can be legally charged in the market.

However price floor has some adverse effects on the market.

Effect on the market a price floor set above the market equilibrium price has several side effects.

Remember changes in price do not cause demand or supply to change.

Price ceilings and price floors can cause a different choice of quantity demanded along a demand curve but they do not move the demand curve.

Producers are better off as a result of the binding price floor if the higher price higher than equilibrium price makes up for the lower quantity sold.

But if price floor is set above market equilibrium price immediate supply surplus can be observed.

Price floors distort markets in a number of ways.

If the government sells the surplus in the market then the price will drop below the equilibrium.

This price must lie below the equilibrium price in order for the price ceiling to have an effect.

As a result they reduce their purchases switch to substitutes e g from butter to margarine or drop out of the market entirely.

When government laws regulate prices instead of letting market forces determine prices it is known as price control.

A price floor also leads to market failure a situation in which markets fail to efficiently allocate scarce resources.

For example they promote inefficiency.